japan corporate tax rate kpmg

Standard enterprise tax and local corporate special tax. Employer companies are required to treat the contribution payments as donations for corporate income tax purposes.

Materials On Corporate Taxation Ministry Of Finance

KPMG Japan Tax Newsletter 2017 KPMG Tax Corporation a tax corporation incorporated under the Japanese CPTA Law and a member firm of the KPMG network of independent.

. Connect with us Find. KPMG Tax Corporation Izumi Garden Tower 1-6-1 Roppongi Minato-ku Tokyo. KPMGs corporate tax table provides a view of corporate tax rates around the world.

Taxpayers need a current guide such as the Worldwide Personal Tax and PDF Country Tax Profile. KPMGs corporate tax table provides a view of corporate tax rates around the world. KPMG Tax Corporations strength is its ability to offer services for a broad range of clients tax needs.

Taxation in Japan 2020. KPMGs corporate tax table provides a view of corporate tax rates around the world. Use our interactive Tax rates tool to compare tax rates by country or region.

The contents reflect the information available up to 31 Octobe Taxation in Japan 2019 -. This booklet is intended to provide a general overview of the taxation system in Japan. National local corporate tax.

Corporation tax is payable at 255. Japan corporate tax rate kpmg. Tax Rate Applicable to fiscal years beginning before 1 April 2015 Tax rates for companies with stated capital of JPY 100 million or greater are as follows.

Produced in conjunction with the. KPMG in Japan was established when KPMG opened a network office in 1954. Regular business tax rates currently apply and vary between 16 percent and 372 percent depending on the tax base taxable income and the location of the taxpayer.

While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended. Corporate tax rates table. For more information contact KPMGs Federal Tax Legislative and Regulatory Services Group at.

Taxation in Japan 2021. 1 202 533 4366 1801 K Street NW Washington DC 20006. National local corporate tax Beginning from 1 October.

Before 1 October 2019 the national local corporate tax rate was 44. KPMG Tax Corporation either through your normal contact at the firm or using the contact details shown below. The effective corporate tax rate using Tokyo tax rates applied to a company whose stated capital is over JPY100 million is currently 3564 percent.

Use our interactive Tax rates tool to compare tax rates by country or region. Use our interactive Tax rates tool to compare tax rates by country or region. While the information contained in this booklet may assist in gaining a better understanding of the tax system in Japan it is recommended.

Tax revenue stood at 48 GDP in 2012. Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their.

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)

Countries With The Highest And Lowest Corporate Tax Rates

Tax Advice With Respect To Inbound Investments Kpmg Japan

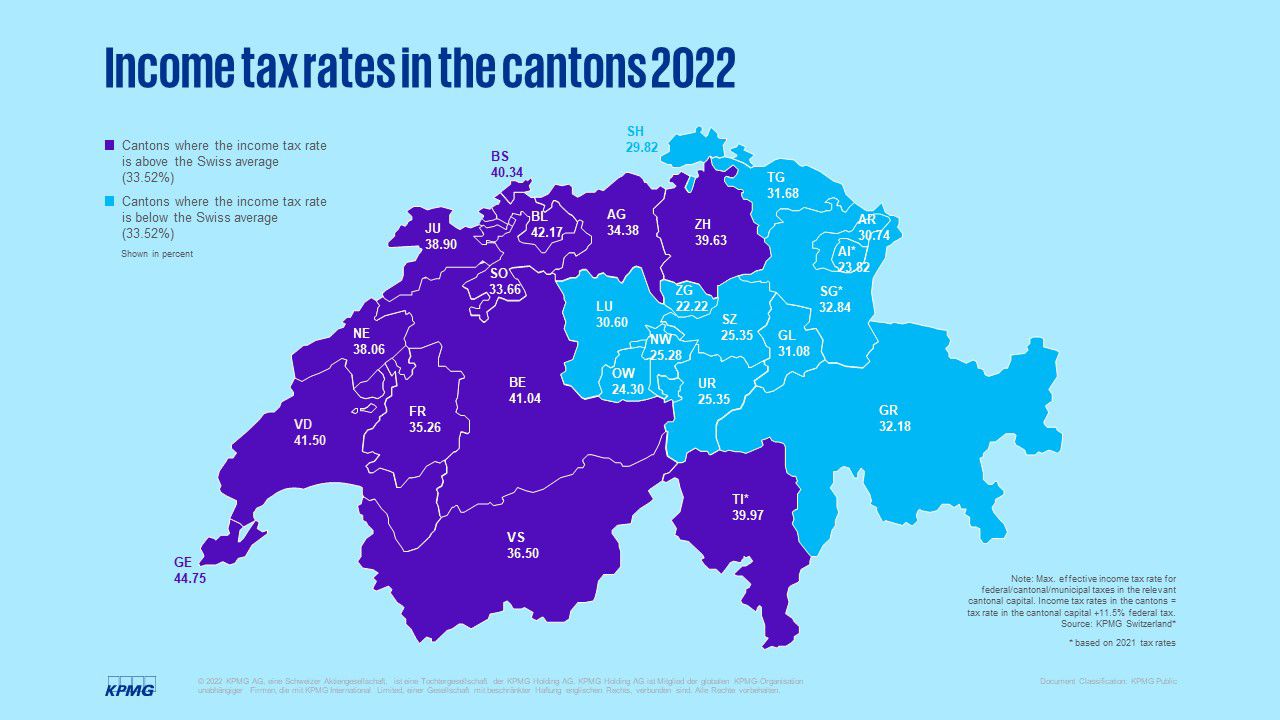

Kpmg Swiss Tax Report 2022 Kpmg Switzerland

Corporate Tax Laws And Regulations Report 2022 Japan

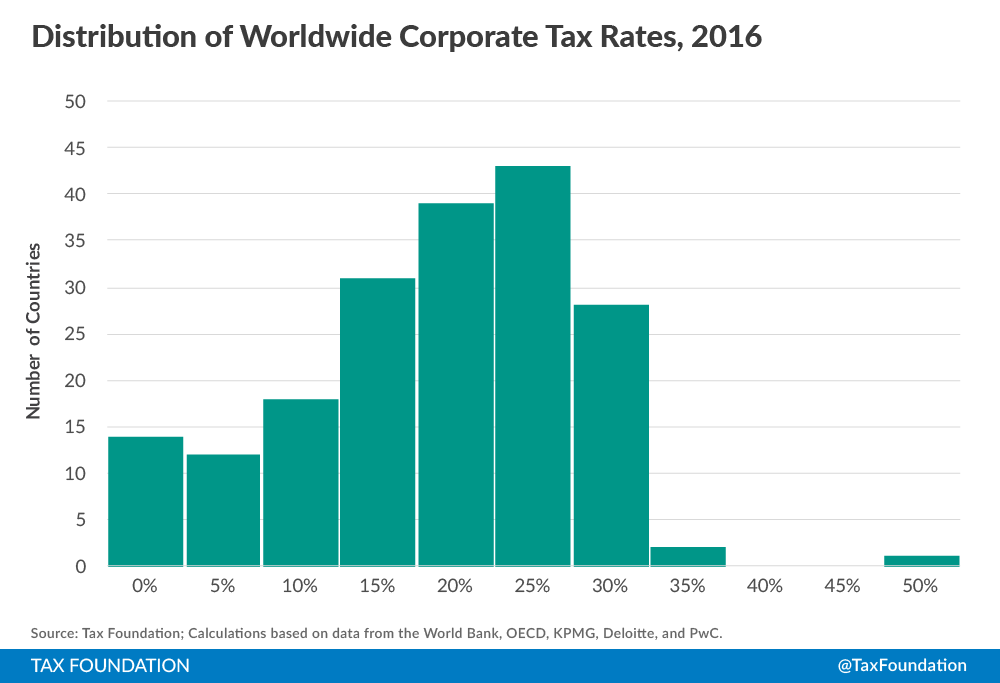

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Kpmg Australia Partners And Staff Enjoy Bonus Windfall

Corporate Inversions The End Again Stout

Big Bang Reform Finance Minister Cuts Corporate Tax In Usd 20 Billion Boost To Growth The New Indian Express

Corporate Tax Rates Around The World Tax Foundation

U S Updates Personal Corporate Tax Change Plans Kpmg Canada

World S Highest Effective Personal Tax Rates

Kpmg Tax Corporation Kpmg Japan

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

U S Updates Personal Corporate Tax Change Plans Kpmg Canada

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Us Watchdog Fines Former Kpmg Audit Boss 100 000 Over Tip Off Scandal Financial Times

Timothy Taylor Blog International Corporate Tax Rates Some Comparisons Talkmarkets

United States Taxation Of International Executives Kpmg Global